The 10-Second Take

What is compound interest?

This type of interest can make a big impact when it comes to long-term investment growth.

WRITTEN BY TAMARA YOUNG ON JUNE 7, 2022

ILLUSTRATION INNA GERTSBERG

10-Second Take:

Compound interest is the interest earned on an investment that builds on previous interest. Essentially, it’s interest on interest.What it means:

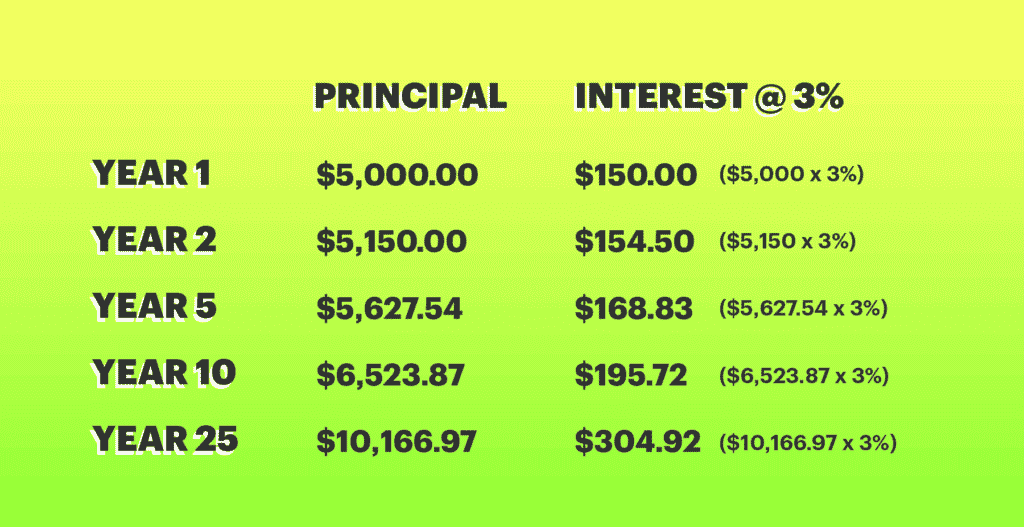

Often associated with personal savings and investments, mortgages, and credit cards, compound interest can help grow (or quickly deplete) your savings over time. It does this by snowballing accrued interest into the principal of an investment or loan. If interest is compounded annually, for example, interest earned this year gets added to the total sum used to calculate interest next year. From a saver’s perspective, it means that your savings or investment will grow exponentially.To understand what this could look like, imagine you’ve just invested $5,000 in a Guaranteed Investment Certificate (GIC) with a 3% interest rate. With compound interest, you’ll earn $150 ($5,000 x 3%) of interest in the first year of your investment. The following year, you would earn $154.50 ($5,150 x 3%). This would continue as long as you leave the account to grow. Although even a few years of compound interest can make an impact on your savings, the power of compound interest is more apparent over longer periods of time.

However, compound interest can also work against you, particularly in the case of loans or debt. From a borrower’s perspective, unless you are making regular payments against a loan’s principal, the debt will likewise grow exponentially.

There’s a simple way to calculate how long it will take for an investment to double with compound interest: Investors often use what’s called the Rule of 72. By simply dividing 72 by the interest rate offered, you can see approximately how long it would take to double your money. Or you can use TD’s compound interest calculator. Compound interest can be a fairly simple way for investors to grow their wealth over time. But if you’re on the other side of the equation and have borrowed money with compound interest, you can see how easy it might be for that debt to quickly build up.c

Book an appointment with a TD Personal Banker

DISCLAIMER: The information contained herein is for information purposes only. The information has been drawn from sources believed to be reliable. Graphs and charts are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the fund facts and prospectus, which contain detailed investment information, before investing. Mutual funds are not covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer and are not guaranteed or insured. Their values change frequently. There can be no assurances that a money market fund will be able to maintain its net asset value per unit at a constant amount or that the full amount of your investment will be returned to you. Past performance may not be repeated. Mutual fund strategies and current holdings are subject to change.

TD Mutual Funds and the TD Managed Assets Program portfolios are managed by TD Asset Management Inc., a wholly-owned subsidiary of The Toronto-Dominion Bank and are available through authorized dealers.

Mutual Funds Representatives with TD Investment Services Inc. distribute mutual funds at TD Canada Trust.

All trademarks are the property of their respective owners.

® The TD logo and other trademarks are the property of The Toronto-Dominion Bank or its subsidiaries.