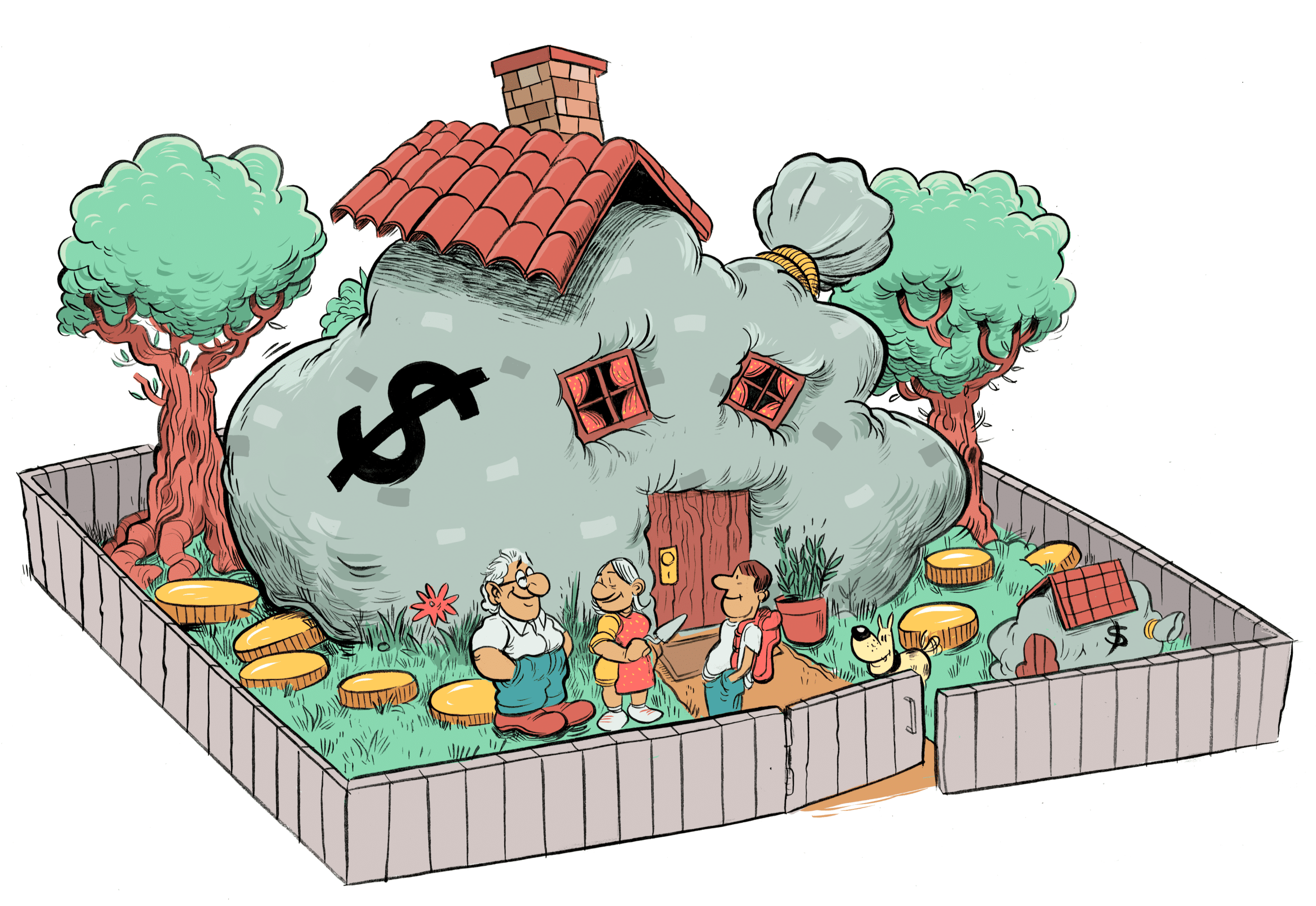

Leveraging your home’s value to achieve financial goals

If you’ve watched your home’s value increase over the years, you may be unsure of how to make the most of that equity. Here are some considerations before you make any moves with your home.

Whether you’re a prospective buyer, investor or casual observer, real estate seems to be top of mind as housing prices continue to remain historically high. [1] But the hot markets of the past decade have made every homeowner wonder: If my home’s value has increased, how can I take advantage of it?

“Having significant equity in your home may have you reconsidering how your house can play a role in your wealth,” says Natasha Kovacs, Senior Financial Planner, TD Wealth Financial Planning.

Few people ever imagined the value of their home would have such an oversized impact on their financial outlook. It can raise mixed feelings: Many of us naturally regard our homes with emotion rather than with dollar signs. However, ideas of how to use your home’s value may begin to percolate when we see how much other houses on the street are selling for. If you are feeling the same way, here are some key considerations.

If you are … considering borrowing against the equity in your home

There are many reasons why you might be interested in using the equity in your home, such as consolidating your debt, paying your child’s tuition or making a large purchase, like a home renovation or car.

A Home Equity Line of Credit (HELOC) is a type of real estate secured loan that may offer lower interest rates when compared to a credit card. Alternatively, refinancing your mortgage could be an option to access equity without selling your home.

With either of these options, Kovacs urges caution when taking on debt, especially if you’re in or nearing retirement. “You should consider your whole financial picture and the costs associated with each option before making a decision,” she says, adding this is something a financial professional can help you with.

If you are … thinking about helping your kids buy a home

Many parents want to help their kids buy a home. Unfortunately, because of the high prices for real estate now, many young people are finding home ownership far out of reach. [2] That leaves Canadians with a tough dilemma: How can they give their kids enough money to afford a down payment without sacrificing their own financial goals?

Again, there are several options to consider, but Kovacs says the first thing any parent should do is look at their own financial situation. “Start by immediately removing the amount you’re willing to give from your financial plan and consider how that impacts you,” she says. “From there, you can decide whether or not it’s worth proceeding.”

The next step is to include your child in a planning discussion to ensure you are properly protecting your own finances. For instance, if you want your adult child to pay you back over time, consider drawing up a loan agreement. To avoid heartache later, a serious talk could also help your child understand what they can afford. This will help ensure that once the funds are provided, everyone is protected.

If you are … reviewing your downsizing options

If you’re sitting on a house that has seen significant equity growth over the years, but no longer suits your needs, you may be thinking about downsizing. Selling may seem like a good opportunity, especially if you are in a position to make a substantial profit, but there are a few things you’ll want to consider. For one, where will you go? If you’re hoping to buy a smaller home, you might be surprised by how the market has inflated even the most modest properties.

“Know your numbers before you begin searching because first and foremost, going to look at homes is emotional. You don’t want to find yourself overleveraged,” Kovacs says. “You’ll also want to consider the expenses associated with any move.”

In addition to real estate costs, moving costs and the land transfer tax, she says many people forget that the new condo they just purchased may come with a higher property tax bill depending on the municipality. Condo fees may also be an unexpected cost. “This can potentially affect your day-to-day cash flow,” she says.

You may be able to better capitalize on the sale of your home by moving farther away from your current region — perhaps somewhere more remote or rural. However, this too comes with its own implications. For example, will your new community have the healthcare amenities you require as you age?

If you are … examining a renovation

If downsizing is something you’re considering for the future, but isn’t pressing right now, you may want to look into renovating your home. Renovations could add value to your house down the road while making it more useful and enjoyable to you now.

A finished basement or high-end kitchen remodeling are examples of renovation projects that could create useful living space in your home. Kovacs says that often homeowners prefer to do renovations slowly. If that’s the case, you might want to get started sooner rather than later, particularly if you’re hoping to sell in the near future. Additionally, if you’re reluctant to dip into your savings or investments and are open to taking on debt, you could consider speaking to a financial professional about your lending options to see what is appropriate for you and your financial needs.

While the drastic increase in home values over the decade may be a good reason to recalculate how that equity fits into our future financial goals, we all understand that our homes are not investment accounts and it’s important to be cautious. The key may be, therefore, unlocking a home’s value while minimizing exposure to financial risks.

“It’s critical to think beyond the present moment,” Kovacs says when speaking of your housing options. She says if you’re considering revisiting your mortgage, downsizing or even renovating, understanding how much money you’ll need in retirement is key — especially if you’re already retired. If you are hesitant as to what your next move should be, Kovacs says meeting with a TD Personal Banker could help you figure out what may be best for your situation and your financial goals.

TAMARA YOUNG

MONEYTALK LIFE

ILLUSTRATION DANESH MOHIUDDIN

Book an appointment with a TD Personal Banker

[+]

| ↑1 | Canadian Home Prices See Sudden End to Declines in Advance of Spring Market, Canadian Real Estate Association, Mar. 18, 2024, accessed Mar. 18, 2024, stats.crea.ca/en-CA/ |

|---|---|

| ↑2 | “‘When will the market bottom out?’ and more questions for TD Economics on the Canadian housing market,” TD Stories, April 3, 2023, accessed Mar. 8, 2023, stories.td.com/ca/en/article/canadian-housing-market-2023 |

DISCLAIMER: The information contained herein is for information purposes only. The information has been drawn from sources believed to be reliable. The information does not provide financial, legal, tax, home financing products or investment advice. Please speak to your financial planner/mortgage specialist for more information.

TD Wealth Private Wealth Management represents the products and services available through TD Wealth Private Investment Advice (a division of TD Waterhouse Canada Inc.), TD Wealth Private Investment Counsel (offered by TD Waterhouse Private Investment Counsel Inc.), TD Wealth Private Banking (offered by The Toronto-Dominion Bank) and TD Wealth Private Trust (offered by The Canada Trust Company).

All trademarks are the property of their respective owners.

® The TD logo and other trademarks are the property of The Toronto-Dominion Bank or its subsidiaries.